The Hidden Costs of Financial Procrastination: Why Time is Money

The old adage time is money has never been truer than in today's fast-paced financial world. Yet, many individuals find themselves caught in the trap of financial procrastination, delaying crucial decisions and actions that could significantly impact their financial future. This article delves into the often-overlooked consequences of putting off financial tasks and explores strategies to overcome this costly habit.

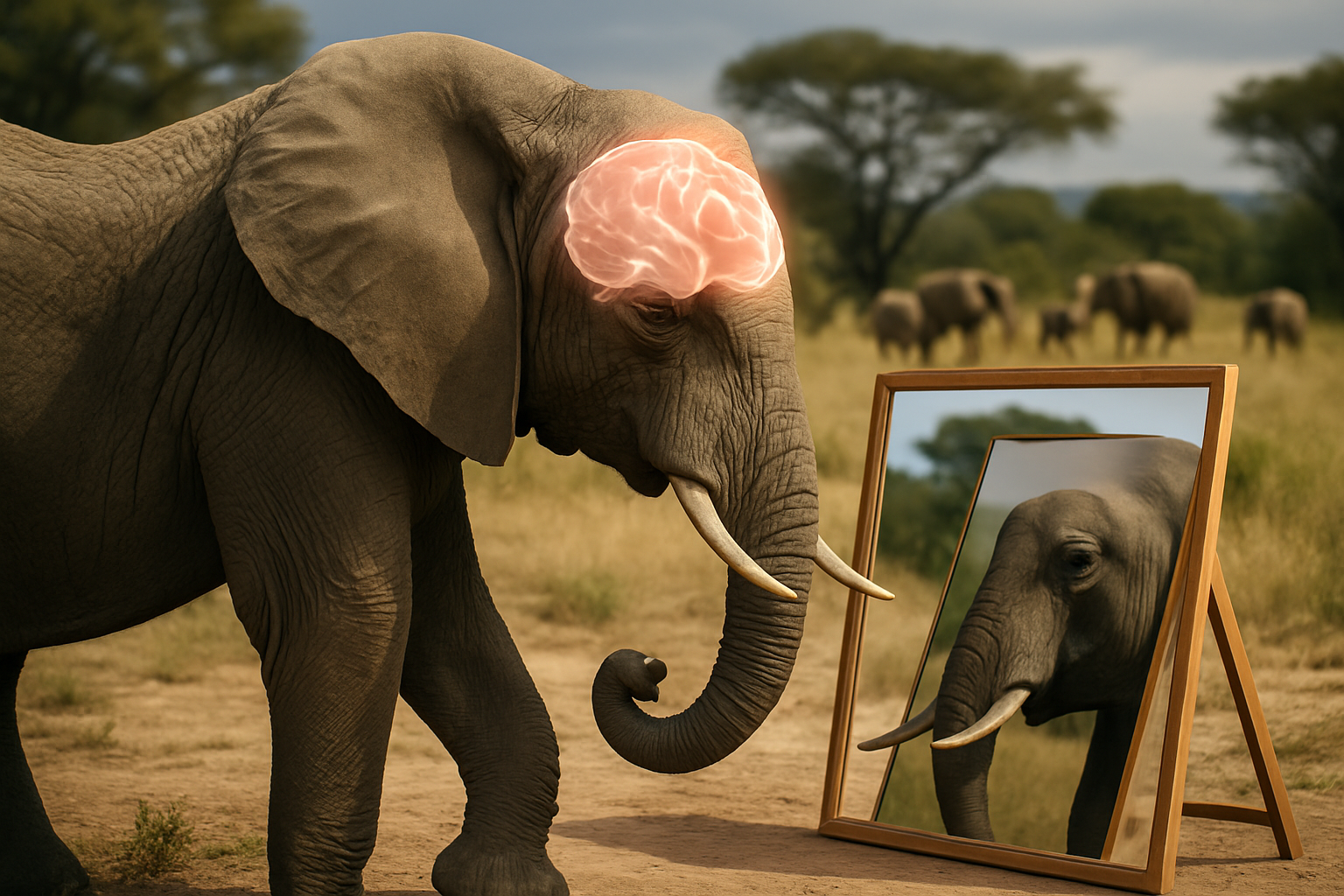

The Psychology Behind Financial Procrastination

Financial procrastination often stems from a complex interplay of psychological factors. Fear of making mistakes, feeling overwhelmed by financial jargon, or simply lacking confidence in one’s financial acumen can all contribute to this behavior. Additionally, the human tendency to prioritize immediate gratification over long-term benefits plays a significant role in financial decision-making.

Research in behavioral economics has shown that people tend to discount future rewards, a phenomenon known as hyperbolic discounting. This cognitive bias leads individuals to choose smaller, immediate rewards over larger, delayed ones, even when the latter would be more beneficial in the long run. In the context of financial planning, this bias can result in postponing important financial decisions, such as saving for retirement or investing in long-term growth opportunities.

The Snowball Effect of Delayed Action

One of the most significant hidden costs of financial procrastination is the snowball effect it creates. Small delays in financial actions can compound over time, leading to substantial missed opportunities and increased financial strain. This is particularly evident in the realm of retirement savings and investments.

For instance, consider two individuals who start their careers at the same time. One begins contributing to a retirement account immediately, while the other delays for just five years. Assuming an average annual return of 7%, the early starter could accumulate nearly twice as much wealth by retirement age, even if both individuals contribute the same amount thereafter. This stark difference illustrates the power of compound interest and the high cost of delaying financial action.

The Opportunity Cost of Inaction

Financial procrastination not only impacts direct savings and investments but also carries a significant opportunity cost. By delaying financial decisions, individuals miss out on potential growth opportunities and the chance to build a robust financial foundation. This opportunity cost extends beyond mere monetary value, affecting overall financial stability and future lifestyle choices.

For example, postponing the decision to diversify an investment portfolio can leave one vulnerable to market volatility. Similarly, delaying the purchase of appropriate insurance coverage can result in substantial out-of-pocket expenses in the event of unforeseen circumstances. These missed opportunities can have long-lasting effects on financial well-being and limit future financial flexibility.

The Emotional Toll of Financial Stress

The impact of financial procrastination extends beyond monetary concerns, taking a toll on emotional well-being. Chronic financial stress, often exacerbated by prolonged inaction, can lead to anxiety, depression, and strained relationships. This emotional burden can create a vicious cycle, further hindering effective financial decision-making and perpetuating the procrastination habit.

Studies have shown a strong correlation between financial stress and overall life satisfaction. Individuals who actively manage their finances and make timely financial decisions report higher levels of happiness and lower stress levels. By addressing financial procrastination, one can not only improve their financial health but also enhance their overall quality of life.

Strategies to Overcome Financial Procrastination

Breaking the cycle of financial procrastination requires a combination of self-awareness, strategic planning, and consistent action. Here are some effective strategies to help overcome this costly habit:

-

Set clear, achievable financial goals

-

Break down complex financial tasks into smaller, manageable steps

-

Automate financial processes where possible, such as bill payments and savings contributions

-

Educate yourself on basic financial concepts to build confidence

-

Seek professional advice when needed to navigate complex financial decisions

-

Use accountability partners or financial apps to track progress and stay motivated

-

Celebrate small financial wins to reinforce positive behaviors

Financial Tips for Proactive Money Management

-

Start saving for retirement as early as possible, even if it’s a small amount

-

Review and adjust your budget regularly to ensure it aligns with your financial goals

-

Keep an emergency fund to avoid relying on high-interest debt in times of need

-

Regularly reassess your insurance coverage to ensure adequate protection

-

Stay informed about market trends and economic indicators that may impact your finances

-

Consider dollar-cost averaging for long-term investments to mitigate market volatility

-

Periodically review and rebalance your investment portfolio to maintain desired asset allocation

In conclusion, the hidden costs of financial procrastination can significantly impact one’s financial future and overall well-being. By recognizing the psychological factors behind this behavior and implementing strategies to overcome it, individuals can take control of their financial lives and pave the way for a more secure and prosperous future. Remember, in the world of finance, time truly is money, and every day of delayed action represents a missed opportunity for growth and stability.